Foreign investment is a flow of capital from one nation to another in exchange for significant ownership stakes in domestic companies or other domestic assets. Typically, foreign investment denotes that foreigners take some-what active role in management as a part or their investment.

Needs

- For industrial development

- Job creation

- Easy and affordable access of goods and services

- Increase nation’s productivity

- Increase level of life of general population

- Achieve good economic growth

- Utilize resources available in the country

- Decrease import & increase export

- Balance trade deficit

- Decrease cartelling, artificial scarcity, monopoly

- Strength country’s economy

- Increase competitive capacity of country in international market

Policy

Art 35(2): The stake shall, for the purpose of national development peruse policy of attracting foreign capital and technology while giving priority to indigenous investments.

- Industrial Act – 2067

- Commerce Act – 2065

- Foreign investment and one window policy – 2049

- Foreign investment and Technology transfer Act – 2049

- Foreign investment policy -2059

- BIPPA

- DTAA

- TIFA (NP & US)

Problems with foreign investment attraction

- Policy instability due to changing government & changing policy with it.

- Rocky relation with india

- Bad security situation of the country

- Lack of infrastructure: Road, transport, electricity, communication etc.

- Lacks of law regarding investment security, NRN investment protection

- Bad employee relation (e.g.:- Surya Nepal Garment)

- Weak financial mechanism

- Lack of skilled manpower

- Bandh, strike has projected negative image of the country to investors

- Dual policy regarding open market. Open market concept is embraced theory but government is running its own institutions with subsidy.

Solution

- Long term policy and vision is necessary

- Develop proper legal framework and its implementation

- Strong relation and diplomatic tie among neighbors

- Increase investment in industrial infrastructure development

- Policy stability and industrial security

- Promotion of Nepal on investment friendly country

- Monitoring and evaluation

- Increase effectiveness of investment board

- Improve economic diplomacy

- Investment year 2012/13 initiative was commendable and this kind of effort is necessary in the future as well.

Portfolio foreign investment

It is the entry of funds into a country where foreigners make purchase in the country’s stock and bond markets. It involves transactions in securities that are highly liquid and can be bought & sold quickly. It’s an investment done by an investor who is not involved in the management of a company. It is short term investment.

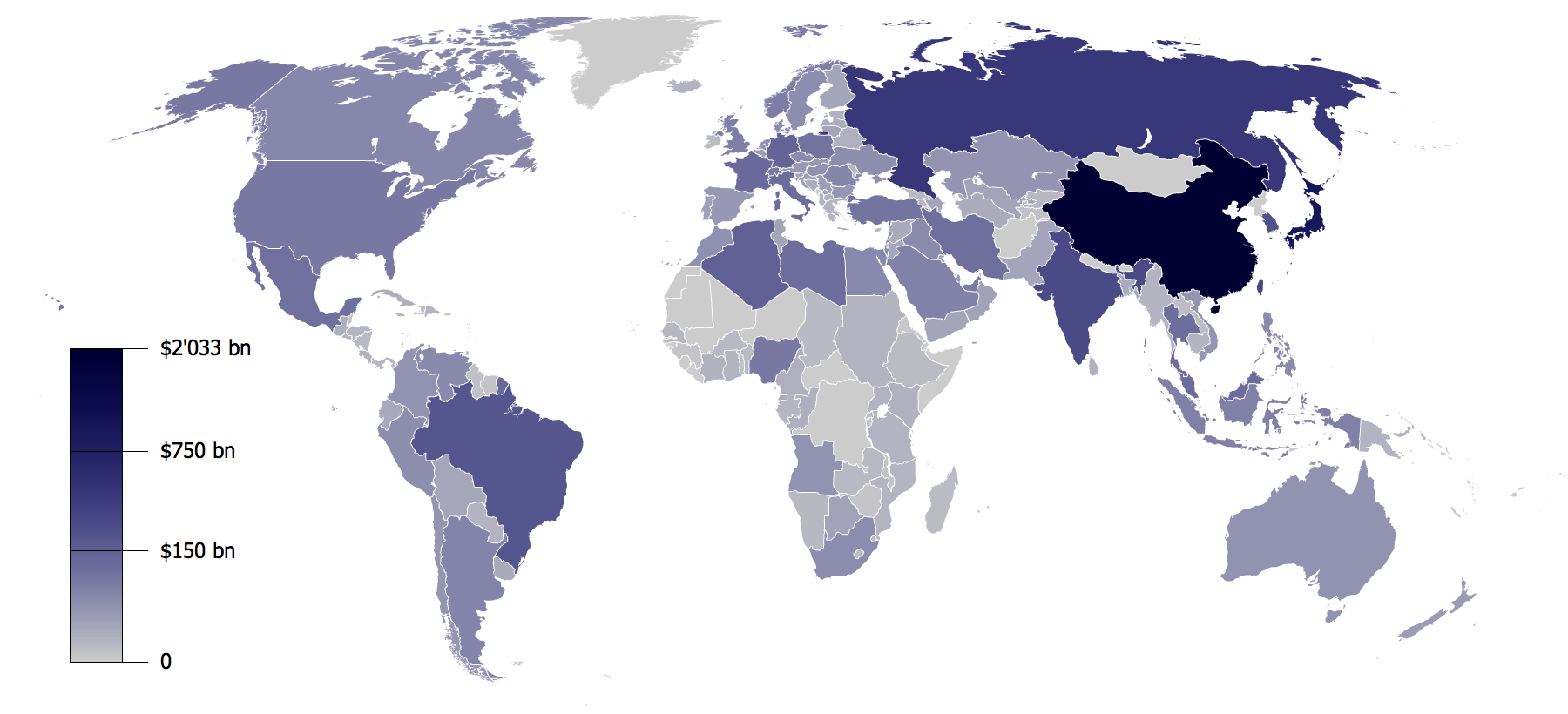

Foreign direct investment

An investment made by a company or entity based in one country, into a company or entity based in another country. FDI investors have a significant degree of influence and control over the company into which the investment is made. Open economic with skilled work forces and good growth prospects tend to attract larger amounts of foreign direct investment than closed, hilly regulated economics.

The acceptance threshold for a FDI relationship, as defined by the OECD is 10%. That is, the foreign investor must own at least 10% or more of the voting stock or ordinary shares of the invest company.

Differences

FPI is passive and FDI is active investment

- FPI has no say on mgmt. but FDI seeks to manage the firm

- FDI duration is generally 1 year or less, FDI is a long term investment

- FPI is less attractive than FDI. FDI is encouraged

OECD= Organization for Economic Cooperation & Development

Recent Comments